Turkey’s import polymer markets have remained under the pressure of persistently thin demand as inflationary pressures, which hit end product markets hard across the board, kept resin consumption tied to limited needs.

*Right-click the image and open a new tab to view the full-sized snapshot.

Sentiment for PP fails to firm up

PP prices took a break from the downturn earlier this month as consumers’ returned to the market and the narrowing price gap with China bolstered the market to some extent. Buyers opted to buy some volumes to reduce their costs despite the ongoing sluggishness in downstream markets.

Nonetheless, sellers’ hopes for a rebound collapsed in the second half of the month since activity waned once again, succumbing to unpromising end markets, financial concerns, and volatile upstream chains.

Saudi Arabian PPH prices were assessed stable at $1360-1380/ton for raffia and at $1380-1400/ton for fibre and injection, CIF Turkey, subject to 6.5% customs duty this week. Players reported hearing slightly lower prices for Russian cargos in a few cases.

“Demand recovery in Asia has been disrupted by new Covid clusters in China. Moreover, the nearing holidays, weaker monomer expectations, and inflation weigh down on Europe,” said players.

Although the market feels free from supply pressure from China amid unfavorable netbacks and Iranian producers remain absent, there is a slew of factors weighing on the PP outlook.

“PP prices should have hit the bottom normally, but things are not promising. The approaching Eid al-Adha holiday will keep demand subdued as carpet makers mull over temporary shutdowns for a couple of weeks next month. This is mainly because of poor end orders, particularly from the US due to rampant inflation,” a player opined.

Cash constraints and the recently lower crude oil markets are other pressure points. Moreover, Turkey may see more than usual volumes from Europe at competitive prices, where propylene contracts are expected to be lower. Hence, players see losses as likely, particularly if Russian sellers focus more on this market.

Slower packaging demand weighs on HDPE film

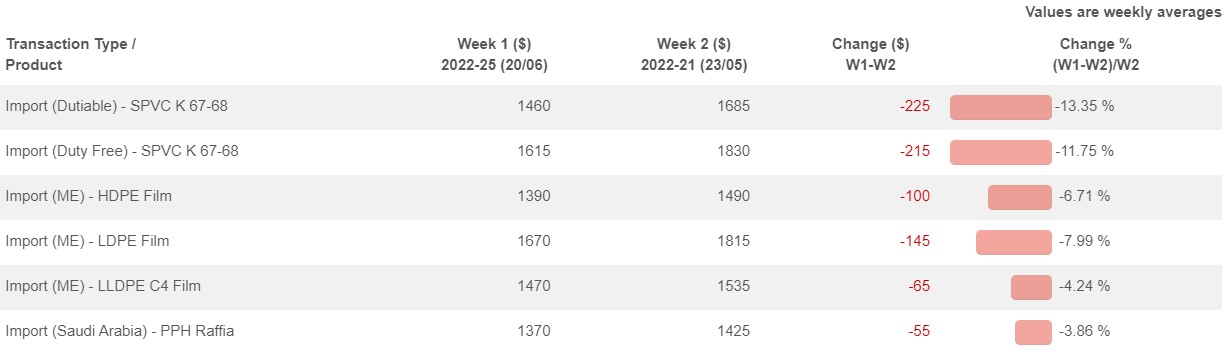

Stagnant end markets found a reflection on the PE market throughout June, with producers revealing drops for the second month in a row. According to the weekly average data from ChemOrbis, Middle Eastern offers have sunk to their lowest levels since September 2021.

Packaging converters confirmed slower demand both in the local and export markets for their end products. One of them said, “High inflation and lower running rates on the converters’ side have taken a heavy toll on orders from industrial packaging. We have been focusing on food packaging applications, which have fared a bit better.” A source from a Middle Eastern producer said, “Bans on plastic bags have hit demand across the board for HDPE film grade.”

Besides, lackluster carpet demand from the USA and Europe continued to keep shrink film appetite low in Turkey and dimmed demand for LDPE grades.

PE players voice bearish expectations for July

July expectations have started to be shaped by bearish factors. Most players concur that the resin price has not been the primary issue since buyers have been suffering from stagnant end product orders, tight liquidity, and financial problems, along with elevated utility costs.

Expectations call for a new round of declines given the economic volatility, while plunging oil prices amid recession fears, the nearing Eid al-Adha holiday and approaching summer holidays in Europe are other factors that weigh on projections.

Meanwhile, the material flow from Russia and Europe will remain under close watch as players do not exclude possible pressure from these origins going forward.

An influx of Asian, Russian cargos keeps PVC on a downtrend

In the PVC market, falling consumption amid inflationary pressures continued to take the center stage as June wore on. An influx of Russian and Northeast Asian cargos exacerbated the pressure on sellers. This also mitigated the impact of an unexpected shutdown at the local producer, Petkim, and modest volumes from Europe.

Russian K67 dropped to $1450-1500/ton CIF/FCA for both new shipments and prompt cargos before reaching $1420/ton later this week. Short sales for US K67 added to the scene, with prices at $1400/ton for late August shipments.

Asian suppliers have followed an aggressive policy following a sharp reduction from a Taiwanese major for July. Chinese sellers remained aggressive with K67 prices ranging from $1400/ton to $1500/ton CIF Turkey. The successive falls in Dalian futures and oil prices as well as cautious downstream markets under the shadow of Covid curbs in some cities, weighed on sellers.

Towards the end of the week, South Korean K67 prices sank to $1560-1570/ton, no duty. According to market speculation, Korean prices have reached around $1500/ton, though this has not been confirmed by primary sources.

The outlook appears to be bearish in the coming term as several manufacturers plan to shut their factories for holidays and global PVC markets remain weak across the board.

(Source: chemorbis)