2021 has proved to be a more challenging year for industry participants than 2020 was, with both spot PP and PE prices skyrocketing to unprecedented levels in Europe. PP and PE markets hit an all-time high in March with PP and LDPE markets hovering around their peaks since then.

Pandemic-driven setbacks, pent-up demand and rising costs have been all contributing to the bullish run. Most importantly, supply bottlenecks have been the key driver of hefty hikes and had the final say over the course of 2021.

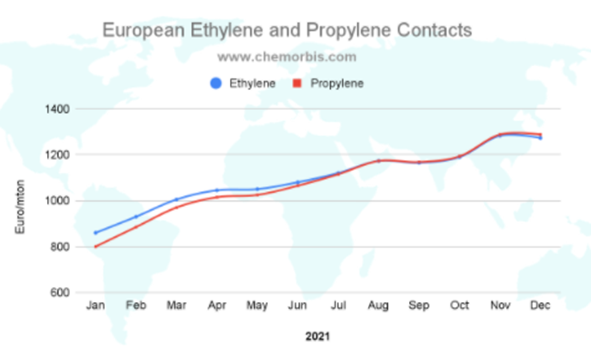

A year of perpetual hikes in monomers

Derivative markets have been well supported by upstream costs amid lower run rates or production issues at regional crackers.

Monthly propylene contracts have settled with increases since January 2021, except for a slight drop in September and rollovers in December. Similarly, ethylene contracts have also been agreed with monthly hikes excluding a cumulative drop of only €18/ton in the September and December settlements.

Short availability pervades PP and PE markets through 2021

After reversing the course in November 2020, PP and PE markets posted 3-digit hikes in the first 4 months of 2021. Prices surpassed their previous peaks in June 2015 by early March and hit an all-time high.

Early in the year, import supplies within the bloc dried up due to the region’s lack of premium over other markets as European markets had failed to catch up with the gains in global markets. Regional availability also shrank due to suppliers’ preference to export to the higher netback regions and a slew of force majeure declarations. Hikes gained steam due to a lack of import material, from the US in particular amid the winter storm. A shortage of containers disrupted shipments also from other overseas suppliers.

That is to say, 2021 was marked by a shortage of supplies amid low stock levels at the producer level and lingering logistics mishaps.

Pent-up demand adds to supply limitations

Apart from this, demand for food packaging and pharmaceutical products remained supported by the pandemic needs. Strong demand in the automotive and construction sectors was also driving demand in various segments. Backlog orders at the converter level and increased mobility after easing of lockdown measures kept purchasing activity robust amid trimmed allocations.

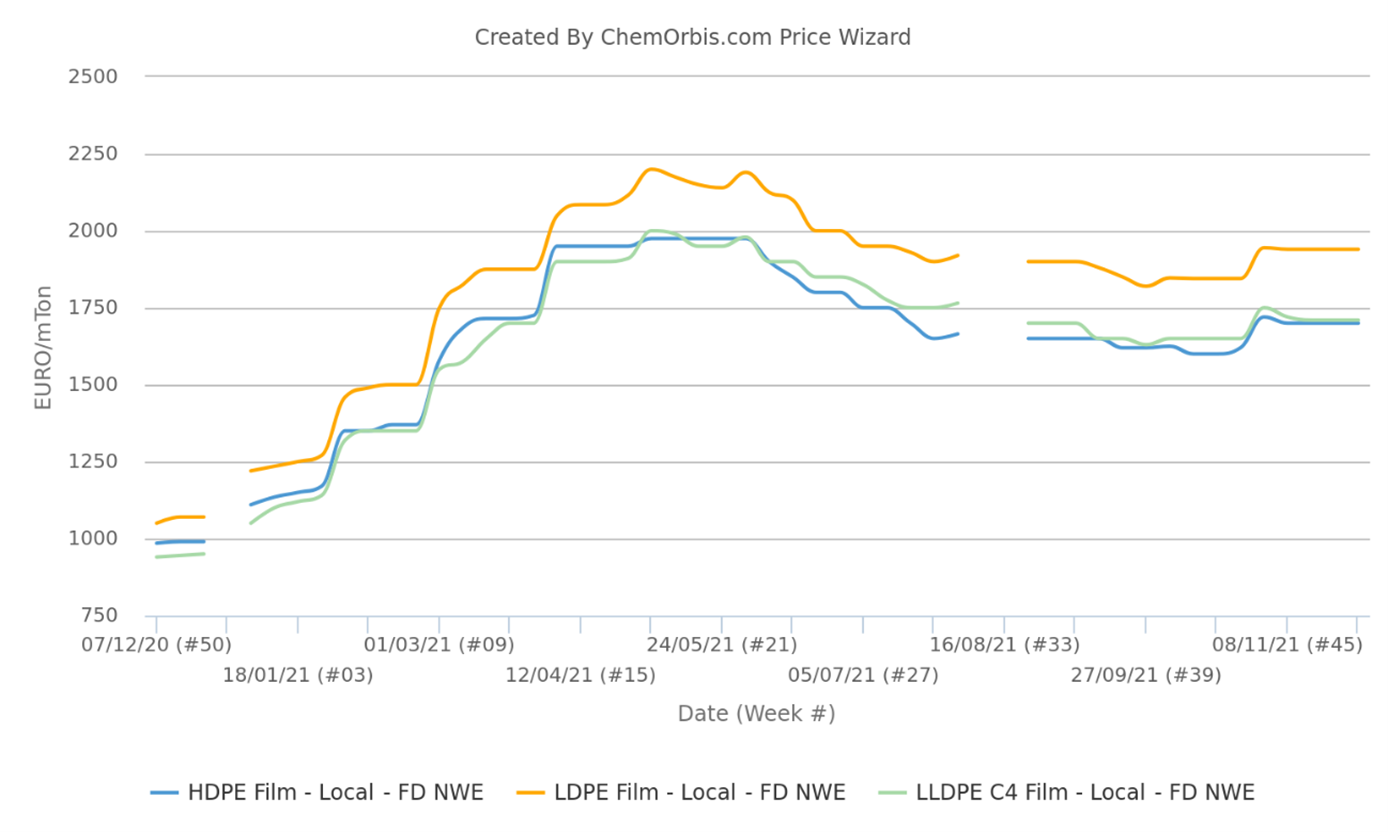

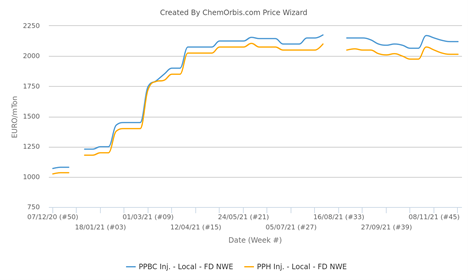

Bulk of gains recorded in Q1

PPH and PPBC prices rose by 54-58% during the January-March period, according to ChemOrbis Price Index. This compares to a total increase of 74-78% from January to May, when prices started to come off their peaks.

As for PE grades, LDPE, LLDPE and HDPE film prices rose by around 50-60% in the first three months of 2021 versus cumulative hikes of 70-90% between January and May.

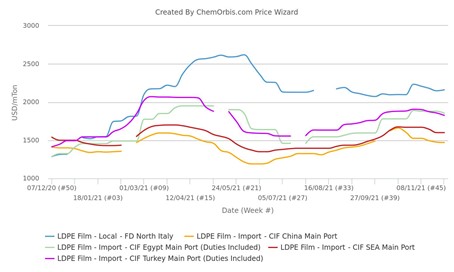

Record-high netbacks lure importers back to Europe in Q2

In April, lingering tightness propelled prices to new highs as exacerbating supply disruptions after the Suez jam encouraged regional suppliers to seek strong hikes. However, buyers grew cautious amid overheated prices and talks of a nearing peak.

This was because an arbitrage window reopened after Europe boosted its premium over other markets. The divergence between Europe and other markets became astronomic as Europe remained relatively unfazed by the broader downtrend in May and June, when other markets dipped to multi-month lows. Juicy netbacks attracted import cargoes to Europe, with the pace of hikes slackening in May.

PE prices saw larger downward corrections than PP

As of June, spot PP and PE markets reversed the course after 7 straight months of hikes after the pressure from competitive import offers mounted.

LDPE remained the tightest grade amid a number of regional force majeures and a lack of imports, while HDPE and LLDPE prices in Italy came under the pressure of aggressive non-European origins. Hence, LDPE posted relatively smaller drops of 16% from May to July. HDPE and LLDPE prices posted 23% drops in Italy, meanwhile.

After hitting an all-time high in May, PP prices in Italy fell by 7-9% until late June, while smaller decreases of 2-3% were seen in Northwest Europe amid limited import availability.

Q3 marked by import delivery delays and supply chain disruptions

The emergence of competitive import origins did not have a long lasting impact as delivery delays of previously purchased import cargoes kept spot availability tight in Europe. Hence, regional producers could keep prices in check during Q3 and avoid major price corrections.

Import cargoes were delayed amid logistical backlogs and longer than usual lead times. Knock-on effects of Suez blockage, floods and port congestions added to the supply chain disruptions. Meanwhile, skyrocketing freight rates and impaired production in the US after Hurricane Ida led to an increase in import PP and PE prices again in September.

Europe stays above other major markets, what lies ahead?

Although import offers lost competitiveness, regional availability started to improve amid returning capacities in Europe. Suppliers pushed for hikes amid soaring energy costs in Q4, while inflated levels and buying fatigue also prevented prices from spiralling up, unlike the case early in 2021.

According to ChemOrbis Price Index, LDPE, PPH and PPBC markets stand at all-time highs. Since overall PP and PE markets still stand at multi-year highs after coming off their peaks by Q2, prices are believed to be ripe for a correction. Europe has been one of the most attractive regions as sky-high freight rates and other logistics mishaps kept the price disparity between Europe and other markets intact.

Record netbacks in Europe will attract bulky quantities from overseas suppliers. US PE offers are expected to put pressure on Europe’s spot markets in Q1 2022, considering delayed deliveries and growing export volumes from the US.

As for PP, the material flow from Asia may be hindered amid container shortage despite massive capacity additions in China. However, price corrections will be inevitable for this product, as well, amid mounting resistance to inflated prices heading towards 2022.

(Source: chemorbis.com)