2020 is not ending as many expected in the European polyethylene (PE) and polypropylene (PP) markets, and sentiment has changed significantly in the last few weeks.

2020 was expected to be a poor year, as imports of ethane-based PE, mainly from the USA, were expected to arrive in greater supply.

In fact, there was an increase in PE and PP packaging, caused by strong buying as the first wave of the coronavirus pandemic sent buyers rushing to the shops.

Other industries were shut down, such as automotive, where 10-11% of PP is used.

By the second half of the year most applications were returning to normal. Automotive has fared better than expected, and packaging is back to normal levels. Those involved in health and hygiene have remained good throughout.

The appliances sector also has recovered beyond expectations in H2 2020, including both small and large appliances.

By the end of the year, a slowdown in polyolefin buying is the norm, with the odd special deal thrown in to boost sellers’ volumes, but this has not been the case in 2020.

Low prices in Europe, both for PE and PP, have meant that exports became a strong feature of the fourth quarter of 2020, leading to a tight market, particularly in the PP sector. Hurricane Laura prevented US imports, which added to the tightness, generating export opportunities to Latin America, among other destinations.

Rather than December being a slow month peppered by offers of cut-price material, prices of both PE and PP have jumped, particularly for low density polyethylene (LDPE) and PP.

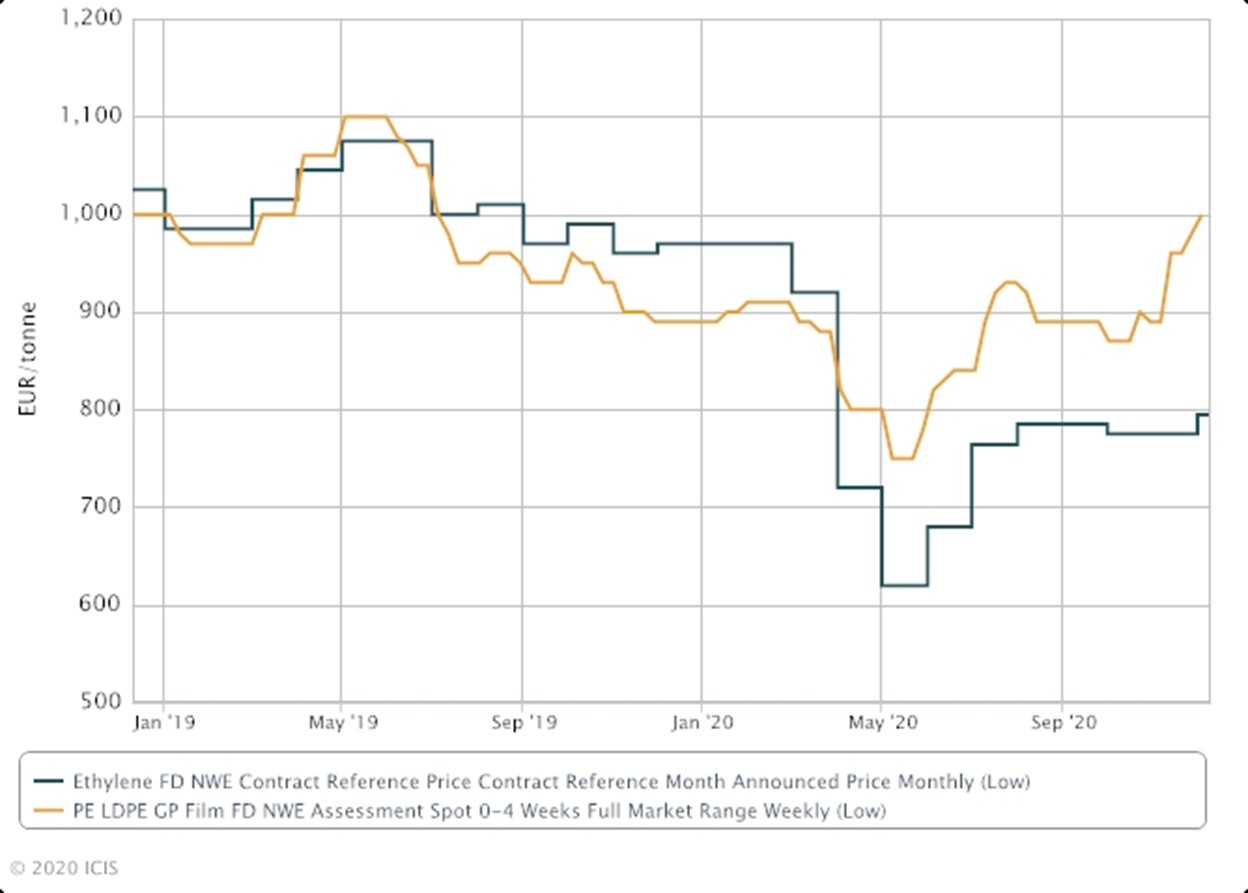

The spread between the ethylene contract and PE has widened in 2020, from a very low base in 2019.

Not only are prices rising amid tight supply, but some producers are already warning buyers that the upward trend could well continue into January.

The recent price hikes in Europe are shortening the gap with Asian prices after months of European stagnation, while corresponding prices in China were driven by stellar domestic demand, especially since mid-Q3 2020.

Buyers argue that December and January are short months. There may yet be time for some of the production issues contributing to the tightness to go back to normal, easing the short supply.

Imports are not expected to resume until well into the first quarter, according to many sources, however, and this will affect the market.

When fresh imports are expected to reach Europe, from late January 2021, domestic demand in China will decelerate ahead of the Lunar New Year holiday period. This will probably help to realign prices in the regions, according to ICIS analytics.

Annual contracts for 2021 are under discussion at this time of year, and while the current tightness favours sellers, the second half of 2021 is not expected to remain as strong, so some pragmatism is entering the debate. Contracts are by no means all done, but several buyers said they have managed to achieve discounts of a couple of percentage points over 2020 for PP.

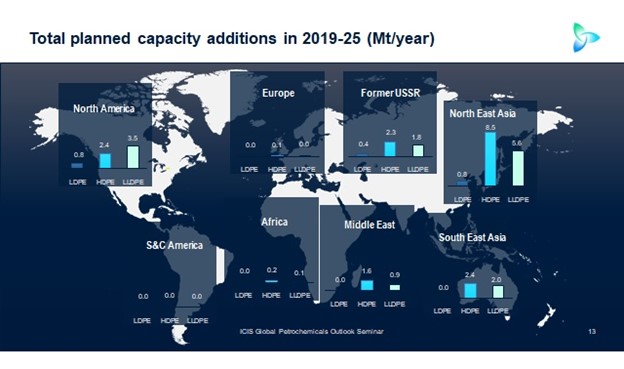

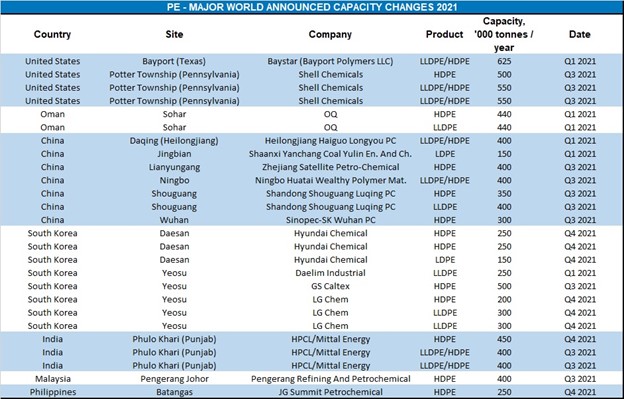

PE is expected to be more readily available, as global supply increases.

In terms of PE demand, ICIS analytics expects a slow but constant recovery during 2021, accompanied by expectations of improved economic conditions in Europe and globally. However, the PE market in 2021 could face a strong supply increase as effective PE capacity globally is expected to increase by 6.5% in 2021 versus 2020. This is likely to lengthen the 2021 supply and demand balance.

Effective global high density polyethylene (HDPE) capacity, in particular, is expected to increase by more than 8% year on year in 2021, while global linear low density polyethylene (LLDPE) and LDPE capacities are expected to increase by 7% and 3% respectively, in the same period.

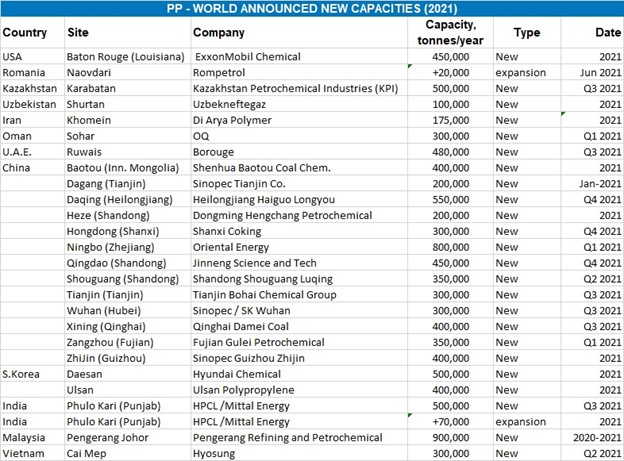

PP supply will increase considerably in 2021 and especially in Asia, where 7.7m tonnes/year of new capacity will be brought onstream, corresponding to 10% of the PP volume processed globally in 2020. The effect on pricing is expected to be felt on the markets especially in the second half of the year.

The global ethylene market should show signs of improvement throughout 2021, according to ICIS analytics, on the assumption that the worst of the coronavirus pandemic impact will be over. Uncertainty over economic growth and distribution of coronavirus vaccines, as well as their effectiveness, might significantly weigh on supply and demand fundamentals. European ethylene is expected to remain long as supply increases.

Globally, propylene demand should increase at a higher average annual growth rate than GDP in 2021, but much depends on how global economies fare.

PP supply will also increase and no tightness is expected, although PP is not expected to see the same oversupply as PE.

Ultimately demand in Asia, and more particularly China, will have a significant impact on both PE and PP trends in Europe in 2021.

Source: ICIS