Many Asian PP and PE producers have either cut or considered lowering their operating rates recently as multi-year high spot naphtha and olefins prices have wrecked margins. Spot ethylene and propylene are currently priced at or even above some PP and PE prices across Asia.

Secco, Shouguang Luqing PC, Sinopec Zhongke (ZGRPCL – KPC JV), Sinochem Quanzhou, Fujian Ref & Petrochemical (FREP), LCY Chemical Corp.,Sinopec Shanghai Petrochemical, ZRCC, Sinopec Maoming PC, Tangshan Risun Chem, Anhui Jiaxi New Materials Technology Co Ltd, Zhong’an Coal Chem. are among some of the producers that have already cut their run rates in China.

Not only producers in China, but also some major producers in Malaysia and Thailand have cut their run rates by 20-30%

PE

Taking the recent ethylene prices at $1360/ton CFR NEA – which is the highest of more than three years – into account and adding a conversion cost of $200/ton on top of it, the theoretical production cost of PE comes to around $1560/ton, not including sellers’ margins.

Meanwhile, local HDPE and LLDPE prices in China are currently standing at CNY9,400-9,600/ton and CNY9,100-9,500/ton ex-warehouse, cash inc 13% VAT. They come to around $1286-1300/ton and $1245-1295/ton respectively, not inc VAT, suggesting a huge gap of around $300/ton.

In the import market, the highest HDPE and LLDPE prices reported this week are at $1300-1350/ton CFR China, standing below the spot ethylene prices.

PP

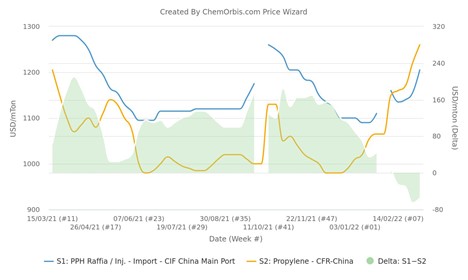

In the case of PP, the theoretical production cost corresponds to $1460/ton CFR NEA after adding an estimated conversion cost of $200/ton on top to the current propylene prices, which are at $1260/ton CFR NEA, highest since October 2014.

Therefore, PP is under a much heavier strain as the highest import homo PP raffia price reported this week in China is at $1230/ton CIF. In the local market, homo PP raffia and injection prices are reported at CNY8,900-9400/ton ex-warehouse, cash inc VAT, which come to $1217-1294/ton without VAT.

Reduced run rates to lead to tightness over near term

Market players speculated that suppliers’ strategy to bear with the high feedstock costs will lead to supply tightness over the near term.

“Crude oil prices have risen significantly, driving propane and propylene prices higher. Many PP plants, particularly naphtha-based and PDH plants are either reducing run rates or undergoing turnarounds. We think more plants will follow suit in the upcoming days and supply will be limited,” a PP trader in China said.

A seller said, “Both naphtha and olefins prices have increased sharply, pushing some producers to reduce production rates. We think supply will tighten further as a result of this strategy pursued by suppliers.”

(Source: Chemorbis)