April hikes carried European PS and ABS markets to unprecedented levels as the rally gained momentum amid surging costs, while Asian markets were softer under the shadow of weak demand. Since Europe has been trading well above global markets, particularly Asia, the disparity between the two regions has grown big enough to set a new record.

European markets shattered by massive hikes

Having reversed course as of March, PS and ABS markets in Europe extended gains into the second month in April. Regional producers approached the market with increases of around €400-450/ton in most cases, with the bulk of the increase coming from higher styrene settlement. Suppliers also implemented energy surcharges, which varied in size from producer to producer, on top of the cost pass-through from feedstock settlements.

Accordingly, both PS and ABS prices hit fresh record highs as they surpassed their previous peaks seen respectively in May 2021 and January 2022.

Strong costs support sellers despite murky demand outlook

Sellers are staying adamant at their current price levels despite approaching Easter holidays. A few domestic producers reported that they have been selling their monthly allocations faster than expected. They attributed this to the shorter working month as well as surging spot styrene prices amid tightness.

Trinseo declared force majeure on its styrene supplies from Terneuzen, while another regional producer was also reportedly facing production issues. As a side note, a styrenics producer reportedly reduced its PS allocations due to tight styrene supply and soaring production costs.

Indeed, ChemOrbis data revealed that spot styrene prices on FOB NWE basis posted a cumulative hike of around $530/ton from three weeks ago.

A few producer sources said, “We are selling smoothly as opposed to earlier expectations, while previously booked cargoes saw no cancellations. Being aware of the styrene tightness and rapid hikes in spot prices, large-scaled buyers accepted paying April hikes.

Nonetheless, it is true that April sales volumes will be much lower than March due to inflated levels.”

On the demand front, however, a rather cautious purchasing activity was observed on the side of small and medium sized enterprises (SMEs) as well as distributors, who do back-to-back business. They were shattered by the extent of fresh hikes on top of up to 3-digit increases in March as they have already been grappling with rising utility costs amid high inflation. PS demand continued to outperform ABS, meanwhile.

Weak demand reigns Asia’s styrenics markets

Asian styrenics markets, meanwhile, started April on a stable to slightly softer note amid a lack of support from the demand side.

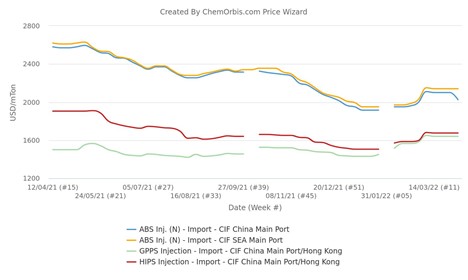

Import PS prices in China and Southeast Asia have plateaued in the past three weeks after following an upward trend since early February. This was because persistently weak demand was counterbalanced by slightly firmer styrene and low availability resulting from reduced run rates.

The extended lockdowns in Shanghai have had a dire impact on logistical operations and purchasing activity. Downstream industries felt no urge to purchase due to the bleak demand outlook amid surging COVID cases in China.

Although slower container circulation curbed the import flow to Southeast Asia and kept supplies limited, downstream demand was not strong enough to push prices up. On the contrary, lockdowns in China and macroeconomic pressures keep buyers on their toes.

When it comes to ABS, China’s import prices declined by $70-80/ton as a lack of demand took precedence over tight supplies. Low local ABS prices in China also halted demand for import cargoes, also pushing suppliers to reduce their offers to the country.

The surge of COVID cases is not abating in major industrial hubs of China, which in turn curbed demand further. Import prices in China stood below those in Southeast Asia due to weaker demand, meanwhile. Whether the warmer weather conditions will prop up demand for refrigerators or air conditioners will also be closely watched.

In Southeast Asia, meanwhile, import ABS prices were propped up by supply constraints emanating from lower run rates and logistics issues, despite weaker China markets.

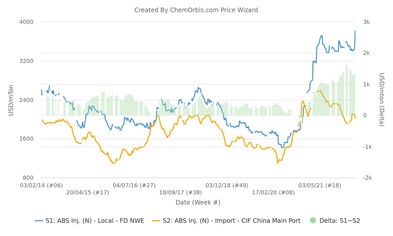

Delta between Asia and Europe widens further

As a result, Europe’s premium over China and Southeast Asia grew further to hit record highs, making Europe a preferred destination for exports.

Data from ChemOrbis Price Index suggest that the premium Northwest Europe carries over China and Southeast Asia’s import ABS inj. markets has grown notably. European prices currently show a premium of $1785/ton to prices in China, while the premium against Southeast Asian prices is currently at $1670/ton.

Europe’s GPPS and HIPS extrusion markets stand roughly $1100-1200/ton above China’s import GPPS and HIPS injection markets, meanwhile.

At this point, logistics operations will be a key determinant in terms of resumption of imports from Asia as the arbitrage window is wide open. Sky-high freight rates, equipment shortages as well as long lead times have so far eliminated arbitrage opportunities despite deepening disparity between Europe and Asia.

(Source: chemorbis)